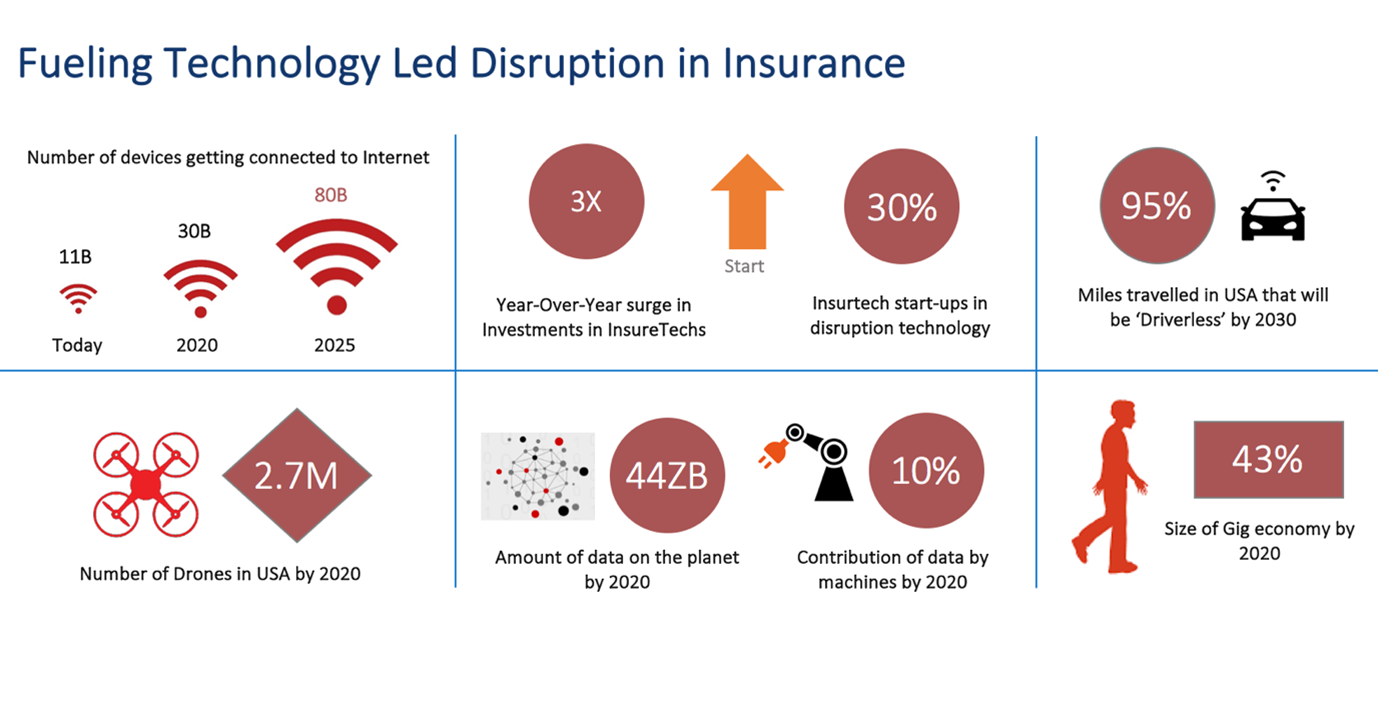

The insurance industry is entering into an era of major advancements in technology that will translate into an exponential rate of disruptive transformation. Insurance companies are increasingly finding themselves getting into a technology race in the marketplace. They realize that how well they adopt insurance technology software and innovate using it will be the single most differentiating factor. And the ones who do not start implementing this as their business practice, might soon face 'the Kodak moment'. Fueling the disruption in insurance is a digital revolution in the surrounding business and social environment.

Here are five highlighted trends that underscore the role and importance of technology in the insurance industry.

An insurance company of the future will embed smart algorithms across its business processes. Decisions will be made in a fraction of a second based on analyzing huge sets of structured and unstructured data across a variety of internal and external sources. Advanced analytics technology will virtually form the backbone of insurance companies enabling them to better understand customer behavior, price and underwriting risks accurately, control fraud, predict losses and expeditiously settle claims.

The insurance industry of the future will be known more for its role in risk avoidance rather than loss indemnification, thanks to the rapidly growing adoption of 'Internet of Things'. Real-time streaming data about customer’s risk behavior will enable insurance companies to price risks more accurately and dynamically. They will be able to gain deep insights for designing innovative products and services. This technology also provides an excellent opportunity for insurance brokers and agents to elevate today’s low-engagement relationship that it has with its customers to a true partnership

As Artificial Intelligence Technology matures to deliver human-like interactions, it can fundamentally change the cost and efficiency basis for insurance companies. It can also simplify interaction with some of the complex insurance processes and technology that exists today. But looking beyond, it can combine business context with intelligence to not only deliver a delightful customer experience, but improve an insurance company’s ability to advise its customers, cross-sell/up-sell products, settle claims straight-through and/or deliver a range of new services.

We envision that Smart contracts will become mainstream in the insurance industry by the end of 2020. This self-governing and self-executing business model, enabled by Blockchain, will replace today’s inefficient business processes and subjective assessment of insurance clauses. Insurance with parametric triggers, such as a weather based product, are perfect candidates to go the Blockchain way. A third party index can trigger transactions from an existing custom developed software or management systems. The industry has already seen implementations in the area of Travel insurance and Catastrophe bond payments. CAN YOU PLEASE PROVIDE EXPLANATION, WE ARE NOT SURE WE UNDERSTAND

As Insurance companies induct the next generation of talent(s), they will have to transform the workplace and reposition itself as an on-demand organization. They need to look beyond the traditional labor market and virtualize part of their workplace in order to meet their skill demands. A seamless integration with partners will also be essential, if not more. New age collaboration platforms and management systems will offer a means to achieve this goal. Many insurance organizations are already tapping into platforms like WeGoLook which acts as an 'Uber of Inspections' that can dispatch experts to conduct auto and property risk inspections or for claims. And this trend is bound to grow.

If you are an insurance company or an insurance broker and if you are not in the cutting edge of technology, you are not standing still, you are actually moving backwards.

Injala has been on the forefront in delivering forward looking business solutions for the insurance industry leveraging our unique product range and expertise in custom software development and management systems